Financial Systems as Part of the German Model: An International Comparison of Company Financing from a Spatial Perspective / FinVER

Background

With over 1,400 regional savings and cooperative banks, the decentralised German banking system counts as one factor behind the success of the German economic model and explains its swift return to growth after the financial crisis of 2007-2008, among other things. In fact, German regional banks cushioned a credit crunch in 2008-2009 enabling access to finance, especially for small and medium sized enterprises (SMEs).Therefore, a range of initiatives tend to view Germany’s banking system as a role model and call for the (re)establishment of regional banks in centralised countries like the UK. And yet Germany’s decentralised banking system is also being challenged due to the low interest rate environment and tightened banking regulation, currently causing a strong decline in the number of regional banks. Since this trend towards concentration has no foreseeable end in sight, the survival of decentralised banking in Germany must be questioned in the medium term. Against the background of this decline, FinVER gained more political explosiveness that we have expected at the time of research application at the Hans-Böckler-Foundation in 2013.

Aim and Core Questions of the Research Project

The aim of the research project was to compare the banking systems of Europe by focusing on the spatiality of bank-based business finance. FinVER brings together findings from the case studies of Spain, Germany, and the UK and draws overall conclusions. The main theory guiding the research project relies on the classification of decentralised and centralised banking and financial systems (Klagge, 1995; Verdier, 2002; Klagge and Martin, 2005; Gärtner, 2011; Gärtner and Flögel, 2013; Klagge et al., 2017) and postulates that this differentiation helps to explain varieties of financial systems, especially with respect to SME finance (Gärtner and Flögel, 2014). Our research interest in the cross-country comparison is twofold. On the one hand, we examine the role that decentralised and centralised banks play in business lending and how regional and large banks organise their lending decisions, especially with regard to their distance from clients. On the other hand, revisiting Verdier’s (2002) seminal study, this paper identifies (success) factors that explain why decentralised banking persists. The research project was motivated by the claim made above stating that the decentralised banking system contributed to the competiveness of the German economy, especially the manufacturing Mittelstand and the fact that we are currently observing a decline in the number of regional banks.

Approach and Methods

In order to identify differences and factors explaining these differences, three country cases were selected for comparison that putatively show substantial variation in the centralisation of banking. Germany represents a decentralised banking system. The UK, on the other hand, exemplifies a centralised system, with London as the most important international financial centre in the world. The Spanish banking system’s degree of centralisation lies on the spectrum between the German and the UK cases. Spain also provides an outstanding case for this study, as what were once regional savings banks have been freed from their geographical restriction since 1988, causing a decline in decentralised banking.

We compared the countries using different methods, analysing aggregated data, especially central bank and labour market statistics, as well as individual data from selected banks. The results, however, are quite heavily based on qualitative work, meaning expert interviews and participant observation. Case studies were conducted on exemplary banks. In total, we conducted over 90 expert interviews with bank employees, banking association representatives, policy activists (e.g. NGOs) and scientific experts. Two research stays, one at the Centre for Urban and Regional Development at Newcastle University in the UK, and another at the University of La Laguna in Spain, enabled us to gather the data.

Key results

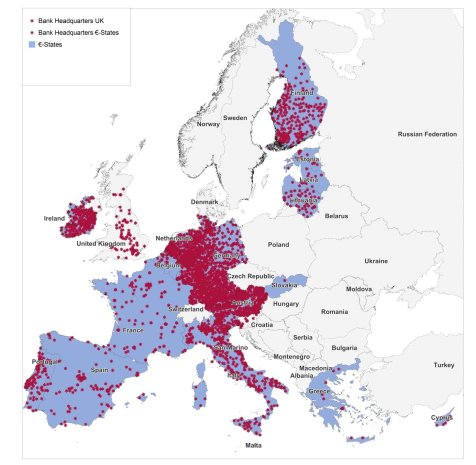

The cross-country comparison has identified Germany as having the most decentralised banking system, followed by Spain and the UK, as expected. The following map of the headquarter allocation of bank in Euro illustrates this differences appealingly.

The development of regional and dual-purpose banks, i.e. savings and cooperative banks, mainly account for the differences in the degree of centralisation. Whereas no such bank exists in the UK any longer and real savings banks in Spain have almost disappeared, two decentralised banking groups with more than 1,400 savings and cooperative banks dominate business finance in Germany. Our comparison has identified three factors of success contributing to the persistence of decentralised banking:

- Short operational and (especially) functional distance and embeddedness in supportive regional bank associations. Short distances allow banks to capitalise on soft information advantages in lending, whilst banking associations also secure access to advanced banking knowledge for banks headquartered in peripheral regions.

- The development of “real” decentralised universal banking. Here, the time when regional savings and cooperative banks received the right to lend is crucial. Because it took them so long to get permission to offer loans, savings banks in Spain and the UK were latecomers to (business) lending, whereas lending had always been the business of German savings banks. Therefore, savings banks in the UK and Spain were not able to capitalise on soft and local information advantages in short distance lending.

- The interplay of the regional principle (regional market segregation), regional embeddedness and a national system that balances regional disparities. Together, these three factors help to make regional banks sufficiently successful, even in economically weak regions, and hinder competition between banks, thereby supporting meaningful cooperation in banking associations and relationship lending.

Savings banks have never been as important in business lending in the UK and Spain as they are in Germany. Though large commercial banks dominate business lending in both countries, some (partly newly established) banks tend to specialise in lending to small enterprises at shorter distances there. To support short-distance lending, this paper suggests a compensation scheme for screening and monitoring costs. Such a scheme may stimulate banks to shift, or preserve, their lending decision processes to the regional level and reduce the need for standardisation, centralisation and bank mergers in times when interest rates are low.

The complete study and country results are available under the following links:

Synthesis paper

Flögel, Franz / Gärtner, Stefan (2018): The banking systems of Germany, the UK and Spain from a spatial perspective: lessons learned and what is to be done? Gelsenkirchen: Inst. Arbeit und Technik. IAT discussion paper 18 (01A).

http://www.iat.eu/discussionpapers/download/IAT_Discussion_Paper_18_01A.pdf

Country case Spain

Gärtner, S.; Fernandez, J. (2018): The Banking Systems of Germany, UK and Spain from a Spatial Perspective: The Spanish Case. Gelsenkirchen: Inst. Arbeit und Technik. IAT discussion paper 18 (02).

http://www.iat.eu/discussionpapers/download/IAT_Discussion_Paper_18_02.pdf

Country case Germany

Flögel, F. and Gärtner, S. (2018): The Banking Systems of Germany, the UK and Spain from a Spatial Perspective: The German Case. IAT discussion paper 18 (04).

http://www.iat.eu/discussionpapers/download/IAT_Discussion_Paper_18_04.pdf

Country case United Kingdom

Flögel, F. and Gärtner, S. (2018) The Banking Systems of Germany, the UK and Spain from a Spatial Perspective: The UK Case. IAT discussion paper 18 (03).

http://www.iat.eu/discussionpapers/download/IAT_Discussion_Paper_18_03.pdf

Acknowledgements

We would like to acknowledge the financial support of the Hans-Böckler Foundation and thank all the participants in the empirical study as well as the advisory board of the project for their valuable comments. Let us also acknowledge the hospitality at the two universities where we conducted the research stays.